tax act stimulus check error

In many cases the IRS can automatically adjust this based on their review. Free 0 Deluxe 45 Premier 70 and Self Employed.

Irs Admits Mistake In Noncitizens Receiving 1 200 Coronavirus Stimulus Checks Npr

TC 570 is a general code and could be due to many factors causing the tax return to be off.

. The new law includes various provisions taking effect in 2020 through 2022. This decision was made after days spent advocating for our customers and pushing the IRS to rightfully send these much-needed stimulus dollars quickly to our customers. The IRS should catch the error and adjust your refund before they issue it.

Are Direct Payments. The first stimulus package included 1200 in direct payments and the next one sent 600 to Americans. The payments will be.

Hundreds of taxpayers were notified to fix filing errors ahead of the deadline in order to get their 1400 payments. However there is also a chance that you miscalculated how much money you would receive. The IRS asks the relatives to return the check.

But those who filed a tax return in 2021 and claimed the Recovery Rebate Credit might have a problem. Upon realization of this error the IRS instructed financial institutions to return the funds to them which is required. 10 2021 we announced the IRS has committed to reprocessing stimulus payments directly to our customers impacted by the IRS payment error.

The correct amount of Recovery Rebate Credit is based on the information in your 2020 return only. You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didnt get an Economic Impact Payment or got less than the full amount. Some taxpayers having problems getting second round of stimulus money.

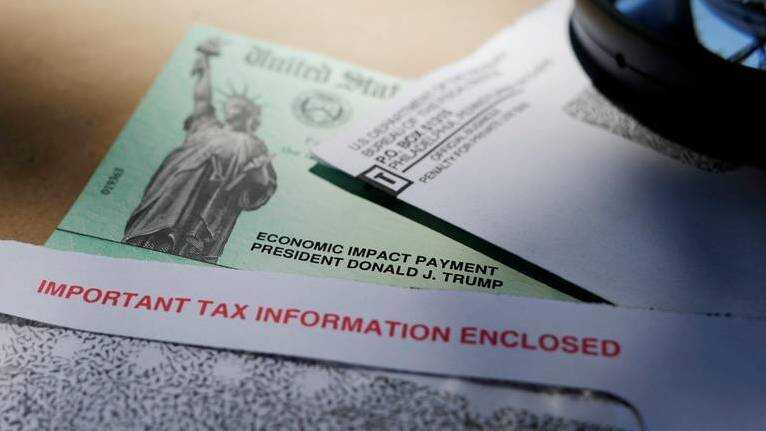

You are supposed to pay it back. In other cases the money was sent to some consumers tax preparers including TurboTax HR Block and TaxAct. A check was issued in the name of a single deceased person - the check was sent in error.

You can no longer use the Get My Payment application to check your payment status. There are no exceptions or alternative interpretations period. The amounts you received as stated in your post would be correct if one of your.

You can also refer to the IRS Statement Update on Economic Impact Payments I received my tax refund via check from the IRS how will I get my stimulus payment. Monthly child tax credit payments will start on Thursday and run through December. I called the IRS when I found out I shouldve received my stimulus payment by.

The IRS deposited my Economic Stimulus Payment into an account at the Bank of Republic because I paid Tax Act for the filing of this return with my return. Offer for Free TaxAct Xpert Assist may expire at any time without notice. Its a monumental task with a.

Stimulus Check IRS Build Back Better Family Security Act Child Tax Credit Stimulus Check Update. The latest stimulus payments as part of President Joe Bidens American Rescue Act sent 1400 checks to Americans. Level 1 21 days ago You wait.

This IRS error caused some people to not. Child tax credit payments could act as stimulus for retailers as soon as this month. Please verify that both of your dependents are under age 17 on your 2020 tax return and your income is showing below 150000.

How to Claim a Missing Payment. Our bank partner complied immediately to ensure we. No one claiming the ACTC Additional Child Tax Credit or EITC Earned Income Tax Credit has received or will receive a direct deposit before February 15th.

The IRS sent some of the stimulus payments to inactive or closed bank accounts. Latest on push for one group to get 4th stimulus check If youre getting ready to file your 2021 tax return click here for steps you can take to make filing easier. This is not a new thing weve been dealing with this since 2016.

1 day agoMarch 10 2022 Topic. If you didnt get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you dont usually file taxes - to claim it. Stimulus payments erroneously sent to closed or incorrect bank accounts by the IRS are being redirected according to tax preparation companies affected by.

An expansion of the premium tax credit for health insurance premiums as allowed under the Affordable Care Act ACA. These updated FAQs were released to the public in Fact Sheet 2022-12 PDF February 17 2022. Thats dictated by the PATH Act.

1909 ET Dec 10 2021. Turbo tax Not calculating stimulus correctly. If you suspect an error you should report this to the IRS at 800-829-1040 and take steps to resolve this.

The IRS did incorrectly send some stimulus payments to the wrong bank account. Please see Second Stimulus Payment Timing FAQs for the most up-to-date information regarding this issue. You may have to wait a few extra months due to this error though 12 level 1 Mod 21 days ago If this is a STIMULUS CHECK or RECOVERY REBATE post please read our megathread post.

TaxAct provides tax preparation software online at four different price levels. Unlimited access to refers to an unlimited quantity of Xpert Assist contacts available to each customer. The IRS issued a stimulus payment based on the 2018 tax return information - that payment is an error.

At the end of the 2019 tax filing season the IRS processed 155 million tax returns - many of which qualify for a stimulus check. I am a bot and this action was performed automatically. It cannot be cashed out anyway as it would constitute federal fraud.

THOUSANDS of stimulus payments were issued this week as the government urged taxpayers to claim their checks by December 23. 1907 ET Dec 10 2021. TaxAct Xpert Assist is available as an added service to certain users of TaxActs online consumer prepared 1040 product.

This code basically means that wages or something on your tax return didnt match the information the IRS has in their systems from other sources eg your employer.

Important Updates On The Second Stimulus Checks Taxact Blog

Rejected Return Due To Stimulus H R Block

Nonresident Guide To Cares Act Stimulus Checks

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

Coronavirus Stimulus Checks Sent To Millions Of Dead People Treasury Department Wants Them Back Abc7 San Francisco

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc11 Raleigh Durham

Irs Admits Mistake In Noncitizens Receiving 1 200 Coronavirus Stimulus Checks Npr

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

Third Stimulus Check Update How To Track 1 400 Payment Status 11alive Com

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc11 Raleigh Durham

Important Updates On The Second Stimulus Checks Taxact Blog

Important Updates On The Second Stimulus Checks Taxact Blog

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Where S My Third Stimulus Check Turbotax Tax Tips Videos

Stimulus Check Problems What To Do If Check Goes Into Wrong Account Irs Get My Payment Portal Shows Error Abc7 New York

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc7 San Francisco

Irs Stimulus Checks Frustrated Americans Left Waiting For Payments As Internal Revenue Service Sends Funds To Wrong Accounts Amid Coronavirus Pandemic Abc13 Houston

Yqya Stimulus Check Delays And How Soon You Could See Your Money Kgan